- Posted On:2022-09-01 13:09

-

807 Views

UK challenges $69B Microsoft/Activision deal, citing potential harm to gamers

The United Kingdom's Competition and Markets Authority (CMA) is challenging Microsoft and Activision Blizzard to justify their planned merger, saying the deal "could substantially lessen competition" in the gaming industry. A CMA announcement today cited concerns about "competition in gaming consoles, multi-game subscription services, and cloud gaming services (game streaming)."

Microsoft announced its plan to buy Activision Blizzard for $68.7 billion in January.

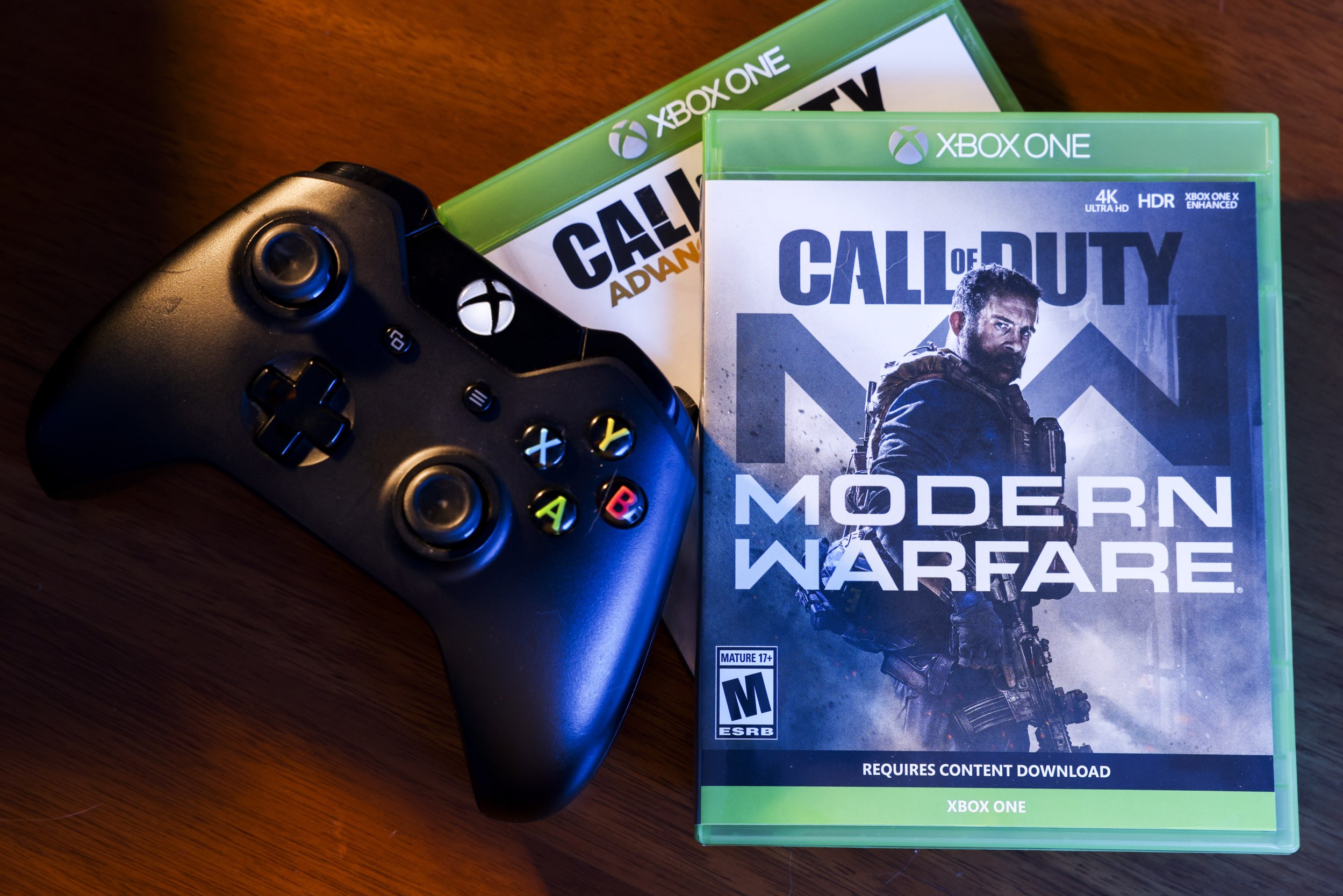

"Microsoft is one of three large companies, together with Sony and Nintendo, that have led the market for gaming consoles for the past 20 years with limited entries from new rivals," the CMA said. "Activision Blizzard has some of the world's best-selling and most recognizable gaming franchises, such as Call of Duty and World of Warcraft. The CMA is concerned that if Microsoft buys Activision Blizzard it could harm rivals, including recent and future entrants into gaming, by refusing them access to Activision Blizzard games or providing access on much worse terms."

The CMA said these "concerns warrant an in-depth Phase 2 investigation," so Microsoft and Activision Blizzard have been ordered "to submit proposals to address the CMA's concerns" within five working days. "If suitable proposals are not submitted, the deal will be referred for a Phase 2 investigation," which would "allow an independent panel of experts to probe in more depth the risks identified at Phase 1," the CMA said.

Besides Microsoft's Xbox console, the CMA noted Microsoft's Azure cloud computing platform and the Windows operating system. "The CMA is concerned that Microsoft could leverage Activision Blizzard's games together with Microsoft's strength across console, cloud, and PC operating systems to damage competition in the nascent market for cloud gaming services," the announcement said.

Phase 2

A Phase 2 investigation can result in a merger being prohibited or a requirement to sell some parts of the business. A Phase 2 investigation is typically limited to 24 weeks but can be extended by up to eight weeks. After a final report, "the CMA has a statutory deadline of 12 weeks (extendable by up to six weeks for special reasons) to make an order or accept undertakings to give effect to its Phase 2 remedies."

In another high-profile case, the CMA launched a Phase 2 investigation of a proposed Nvidia/Arm deal. The companies later scrapped the planned merger.

Amid concerns about Activision games' availability on non-Xbox platforms, Microsoft in February said it "committed to Sony" that "Call of Duty and other popular Activision titles" will be "available on PlayStation beyond the existing agreement and into the future." In March, four US senators urged the Federal Trade Commission to scrutinize the Microsoft/Activision merger.

"If our current concerns are not addressed, we plan to explore this deal in an in-depth Phase 2 investigation to reach a decision that works in the interests of UK gamers and businesses," CMA Senior Director of Mergers Sorcha O'Carroll said.

Microsoft previously completed a $7.5 billion purchase of Bethesda parent company ZeniMax in March 2021. In November, Microsoft Gaming CEO Phil Spencer confirmed in an interview that Bethesda's Elder Scrolls VI will be available only on Xbox consoles and the PC.

Microsoft defends $68.7 billion deal

Spencer defended the Activision Blizzard deal in a blog post today, saying the company wants to expand choices for games and developers:

We are expanding choice in two ways: through the creation of Game Pass, which gives players a subscription option; and by bringing more games to mobile platforms, including through our cloud game streaming technology. Subscription services like Game Pass make gaming more affordable and help players from all over the world find their next favorite game. Game Pass empowers developers to bring more games to more players, not fewer. We intend to make Activision Blizzard's much-loved library of games—including Overwatch, Diablo and Call of Duty—available in Game Pass and to grow those gaming communities. By delivering even more value to players, we hope to continue growing Game Pass, extending its appeal to mobile phones and any connected device.

Spencer wrote that Microsoft hopes "players will be eager to play traditional console games from Activision Blizzard on other platforms via our cloud game streaming technology," saying this will create new game distribution opportunities on mobile devices "outside of mobile app stores." (Game Pass includes a streaming service that was initially called Xcloud.) Microsoft is also still "committed to making the same version of Call of Duty available on PlayStation on the same day the game launches elsewhere," he wrote.

Spencer expressed confidence that a competition review will find that the merger is good for gamers and the industry. "We will continue to engage with regulators with a spirit of transparency and openness as they review this acquisition. We respect and welcome the hard questions that are being asked... We believe that a thorough review will show that the combination of Microsoft and Activision Blizzard will benefit the industry and players," Spencer wrote.

Investigation would obtain internal documents

As for what comes after Microsoft and Activision respond to UK regulators, the CMA described how a Phase 2 investigation would play out:

At Phase 2, the CMA appoints an independent panel to examine the deal in more depth and evaluate whether it is more likely than not that a substantial lessening of competition will occur as a result of the merger—a higher threshold than Phase 1. It typically builds on the work and evidence from Phase 1 with more third-party engagement via requests for information and use of its statutory powers in gathering internal documents. At Phase 2, the CMA will also carry out further in-depth review of the merging parties' internal documents which show how they view competition and the market.

The last Microsoft deal investigated by the CMA was the company's $16 billion purchase of speech recognition software provider Nuance. The CMA cleared it without launching a Phase 2 inquiry.